5 Best Crypto & Bitcoin Lending Sites to Earn Interest 2023

The best Bitcoin lending sites can reduce your stress a lot in 2023.

It’s true. Instead of stressing about trading, you can earn interest on Bitcoin (and other cryptocurrencies) through passive income.

Studies show that when you have passive income, your stress and anxiety are reduced, you spend more time with friends and family, and you enjoy greater freedom to pursue your hobbies and interests, so how much to invest in Bitcoin and do you need to even invest for passive income from Bitcoin find out below.

Going forward, you will find:

- A crypto lending comparison of the 5 best Bitcoin lending sites.

- The 9 factors to consider when choosing your Bitcoin lending platform.

- What is BTC lending and how to lend BTC -- Explained.

- 3 reasons why and how to make passive income with Bitcoin lending platforms

Let’s dive in!

The 5 Best Bitcoin Lending Sites

Each of us at CryptoManiaks has been in the crypto sphere for a long time. As we’ve made mistakes, we’ve also learned.

Here is the sum of our knowledge: a list of the best Bitcoin lending sites we use and trust, and which we consider as the best places to earn interest on your crypto.

And the winners are CoinRabbit, YouHodler, Coinloan, BTCPOP and Xcoins.

Cryptos Avail. Competitive Advantage

USDT, USDC, and BUSD Reputation & Security Earn on CoinRabbit

BTC, ETH, 12+ stablecoins/altcoins Highest rates for stablecoins Earn on YouHodler

BTC, ETH, 5+ stablecoins/altcoins Highest rates for BTC, ETH, BCH, LTC, XMR Earn on Coinloan

BTC, 180+ altcoins Unlimited choice of crypto Earn on BTCPOP

BTC only Interest paid to Paypal in Fiat of your choice Earn on Xcoins Now, let’s do a crypto lending comparison for my favorite platforms. You’ll also see how to earn interest with lending Bitcoin and stay safe doing it.

#1 CoinRabbit

CoinRabbit is a reputable finance platform for lending and borrowing cryptocurrency. Thanks to the partnerships with ChangeNOW and Guarda, the company is able to provide simple transaction and storage solutions.

Since its launch in 2020, we can confirm that CoinRabbit is one of the leaders in the sector. You can now use the platform's services and earn interest on your crypto.

Pros:

- Competitive interest rates for lending your crypto or 8% annual percentage yield

- You can withdraw your deposited crypto anytime as CoinRabbit doesn't tie you down for a certain period

- Saving platform is simple to use, and you can follow your daily earning progress

- Your crypto remains safe thanks to the cold wallets. You can only access these wallets if a number of employees do it for you from the company's office using closed VPNs. These team members are the only people who can approve every single transaction.. Customers can have multiple active deposits at the same time. This means that APY accrues separately on every deposit.

Cons:

- There is only a limited number of cryptos you can use for savings such as USDT TRC20, USDT ERC20, USDT BSC, USDC, and BUSD

- There is a minimum deposit for lending or $100 in stablecoins

- CoinRabbit reserves the right to modify APY upon its sole discretion for all active deposits

Payout terms:

CoinRabbit pays your interest on a daily basis and in the same asset you used for deposits.

If you decide to withdraw your deposit, the process will take less than 10 minutes. Keep in mind that deposits don't have any time frame.

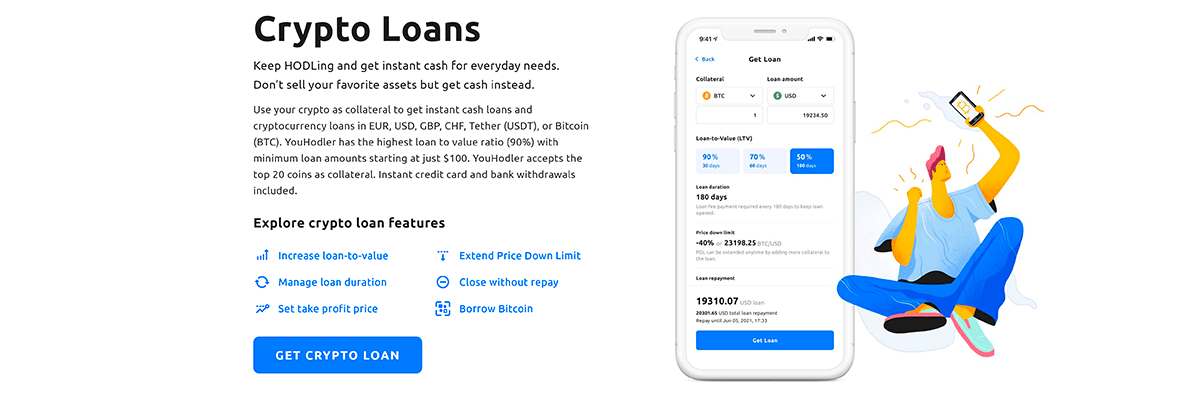

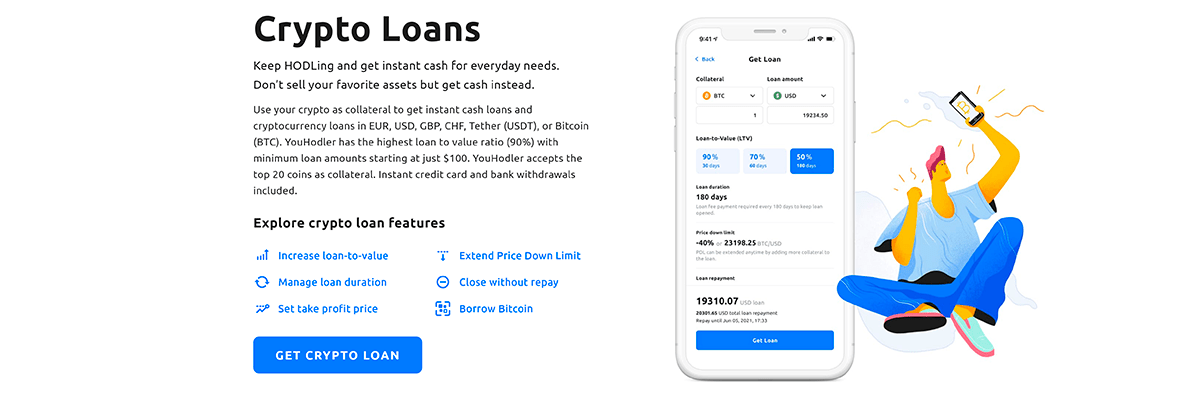

#2 YouHodler

YouHodler is a relative newcomer, but it’s a strong competitor. With YouHodler, you can loan out your bags and earn interest on crypto up to 12% APR

.APR

APR stands for Annual Percentage Rate. It's the interest rate charged during a whole year. For example: borrow $1,000 at 10% APR means at the end of the year you'll pay back $1,100. The extra $100 may be split into 12 payments, once per month, if that is how the creditor asks for them.If you’re more inclined to borrow funds, you can also get a crypto loan backed by the TOP 12 coins with up to 90% LTV

.LTV

LTV stands for Loan-to-value. The ratio expresses the amount of a loan compared to the value of an asset. For example: taking a $1,000 loan and putting up $2,000 worth of Bitcoin as collateral = 50% LTV. The loan is worth 50% of the bitcoin collateral securing it.

Pros:

- Trust. YouHodler is a member of the Crypto Valley Association in the Western Switzerland Chapter.

- Low minimum deposit. Starts at just $100.

- Flexible payments. Instant credit card and bank withdrawals included.

- BNB available. YouHodler is the only crypto lending platform on which you can earn interest on BNB.

- Multi-Hodl. A unique offering letting lenders earn interest on crypto from 80% of their portfolio while using 20% of their portfolio to buy and sell other cryptocurrencies.

- Bitcoin lending interest rate. Lenders earn 4.8% APR on their deposited BTC, which is above average for lending Bitcoin.

- Demo funds. Lenders can first experiment with demo funds to find the best crypto lending option for themselves.

Cons:

- Lacks experience. Young cryptocurrency lending platform without a proven track record.

- Compliance. Strict KYC/AML laws .

- Modest stablecoin APR. Best crypto lending platforms offer higher interest rates to lenders who deposit stablecoins.

- Limited choice. Only BTC, BNB, USDT, PAX, PAXG, USDC, and TUSD are available to earn interest on cryptocurrency.

Payout terms:

Lenders get paid interest at the end of the month.

When you cash out, you have the option of withdrawing in the crypto or fiat of your choice.

#3 Coinloan

Coinloan isn’t a company like the others. It is one of the first P2P crypto lending platforms for crypto-backed loans.

They began in 2017 in Estonia, which is where they are currently located.

They have a simple setup process, bank grade security, and they offer crypto lending and borrowing in various cryptocurrencies.

Pros:

- Trust. Partnered with Ontology, Bitcoin.com, and Acquiring.

- Best Crypto APR. 6.6% for BTC, 5.13% for ETH, 5.97% for BCH, 5.34% for LTC, and 5.13% for XMR.

- High Fiat/Stablecoin APR. 10.5% for Euro, USDT, USDC, TUSDT, and PAXOS.

- Frictionless. Coinloan charges no fees for depositing and withdrawing funds on the platform.

- Wide offering. Coinloan provides plenty of tools to reach your financial goals: crypto-to-crypto or crypto-to-fiat loans, interest account, crypto exchange, and beyond.

- Terms flexibility. You can choose the interest rate, loan term, loan amount, repayment method, etc.

- Always open. Licensed financial institution status and worldwide coverage allow them to offer service almost anywhere and anytime, day or night.

- Transparency. A unique Loan Agreement for each loan is generated, and users can export loan history to CSV for accountability purposes, so that's what a transparent Bitcoin lending platform looks like.

Cons:

- P2P reliant. A young company that relies on a P2P network. Perhaps best to wait for the P2P network to grow so you can borrow or lend crypto for interest more easily.

- Security. No insurance and not much mention of storing customer funds in cold wallets.

- Infrequent Customer Service. No 24/7 chat assistance and wait time might be longer than other competitors.

Payout terms:

Lenders get paid interest at the end of the loan.

The amount is paid via bank transfer (SWIFT, SEPA) or AdvCash.

The interest rate depends on the lender since the lender's “select interest rate, loan currency, term and desired loan amount.”

#4 BTCPOP

BTCPOP was founded in 2014 in the UK by Lee Bartholomew and is currently based in the Marshall Islands.

They offer lender and borrower matching; this means you could possibly find a large range of crypto lending and borrowing options for entrepreneurs, individuals, and new companies spanning the globe.

According to BTCPOP, you can “quickly get loans from other members or make some money by loaning money you have. You set the terms. You set the amount.”

Pros:

- Chat system. Users can discuss terms, details, risks, etc.

- Direct loan servicing. BTCPOP will help you get the loan.

- Currencies available. BTCPOP does not regulate which currencies can be deposited, borrowed, or staked. Since they are a P2P platform, they leave all of this up to their users so they can easily lend BTC.

- Terms flexibility. BTCPOP does not regulate terms, limits, prepayment penalties, deadlines, payout dates, or other items. Since BTCPOP is a P2P platform, they leave all of this up to their users.

- Reputation tracking. BTCPOP tracks the reputations of borrowers and creditors, so everyone’s money stays safer.

- Security. BTCPOP stores its clients’ coins offline (in cold wallets) which separates them from many other Bitcoin lending sites.

Cold Wallet

An offline wallet for holding cryptocurrencies. Considered more secure than hot wallets.

Cons:

- High rates for borrowers. Which might mean less traffic for lenders.

- Trust. Not as many institutional backings or pedigrees as other sites.

- Fees. Since BTCPOP does not regulate or determine rates on loans, BTCPOP instead charges fees. They charge a listing fee of 1% and 2% for any late payments. They also charge staking fees, verification fees and more, which can all be found on their fee list (click “view our fees”).

Payout terms:

Lenders get paid interest when and how they choose.

Each lender sets up their own terms, conditions, interest rate, and coins.

#5 Xcoins

Xcoins was started in August 2018 by a fellow named Sergey Nikitin. He decided to leverage PayPal to make the operation work.

Lenders allow people to borrow their BTC, and in return, the lenders get monthly PayPal payments at various interest levels for lending Bitcoin.

Xcoins is a P2P Bitcoin lending platform, so lenders set their own rates and borrowers choose to take them or not.

Pros:

- Low minimum deposit. Lenders can deposit as little as $20 in BTC and start to earn interest on BTC lending.

- Fixed terms. Lenders who loan Bitcoin for interest can deposit and withdraw anytime, but borrowers must pay off their loan in one lump sum.

- Rate flexibility. Lenders set their own rates. When borrowers require a loan, Xcoins fetches the best offers matching the request.

- Geo-Availability. 167+ countries serviced -- including the U.S. and U.K.

- Trusted. Over 250,000 satisfied customers globally.

- Instant. You’ll receive crypto as soon as you take out a loan.

- 50% guarantee. Xcoins offers a 50% profit margin guarantee to protect its lenders from fraudulent chargebacks.

Cons:

- BTC only. This P2P Bitcoin lending site uses only Bitcoins so the only option for users is to lend BTC. But the crypto space is quite vast and a wider choice of cryptocurrencies would be better.

- User experience. Not as modern and pleasant as other Bitcoin lending platforms.

- No insurance. Customer funds, for lenders and borrowers, are not insured against hacks, scams, or theft.

Payout terms:

Lenders get paid interest at the end of the loan.

The amount is paid to their Paypal or Visa/Mastercard in the fiat of their choice.

Best Crypto Interest Rates -- Compared

Let’s focus, shall we?

Choosing BTC lending sites with the best crypto lending rates for lenders will allow you to get the most bang for your buck.

So let’s take a look at just the rates each of these five crypto lending programs.

Available Interest Rate Terms Interest payout CoinRabbit USDT TRC20, USDT ERC20, USDT BSC, USDC, and BUSD 8% per year Flexible Daily YouHodler BTC, BNB, and stablecoins 3% to 12% Flexible At loan end Coinloan Euro, BTC, 4+ altcoins, and 4+ stablecoins 5.13% to 10.5% Set by P2P Set by Lender BTCPOP BTC, and 50+ altcoins Set by P2P Set by P2P Set by Lender Xcoins BTC only 10% to 15% Set by P2P At loan end Choosing The Best Bitcoin Lending Platform - 9 Factors to Consider

What turns regular BTC lending sites into the BEST Bitcoin lending platforms?

It’s a combination of several important factors.

You should consider at least the following factors.

1. Best crypto lending interest rate

Pay attention to both the interest rate offered to borrowers and the interest rate offered to lenders.

Source: Wall Street Survivor YouTube Channel

The interest rate offered to borrowers should be low enough to get them borrowing while high enough to earn money for the cryptocurrency lending platform and lenders.

The crypto lending rate should also be balanced enough to give lenders a good return.

2. Security

It won’t matter if lenders earn high amounts of interest on Bitcoin or other cryptocurrencies if it ends up being stolen through hacks or exit scams.

Make sure to use cryptocurrency lending platforms with a level of security you feel safe with, as well as lending out only the amount you’re okay with losing.

3. Cryptocurrencies available

How many cryptocurrencies does a platform offer for lenders to deposit?

Some platforms like Xcoins only let lenders lend BTC.

This is great if lending Bitcoin for interest is the only cryptocurrency you have or want to use. But many people in the crypto space also have altcoins sitting around and they don’t want to lend Bitcoin only.

If you have other altcoins or stablecoins you want to put to work earning interest for you, then consider going with a platform like YouHodler or Coinloan.

If you prefer P2P

lending, BTCPOP offers 50+ altcoins to earn interest on crypto.P2P

Peer-to-Peer. Refers to networks in which individuals connect to each other rather than a central authority.

4. Reputation

Some lending platforms, like YouHodler for example, are fairly new. They haven’t had time to build up a solid reputation yet.

That doesn’t mean you should stay away, only that you should be a little more cautious with how much money you put in.

5. Term flexibility

Some platforms, like CoinRabbit have very flexible loan terms.

Borrowers can pay off their loan anytime with no penalty; lenders can withdraw their funds anytime without penalty too.

Other sites like Coinloan, however, are P2P

platforms; they let users borrow and lend crypto with each other and set up their own terms.P2P

Peer-to-Peer. Refers to networks in which individuals connect to each other rather than a central authority.Take time to think about how flexible you want to be with your funds.

6. Payment Frequency

CoinRabbit charges interest on your loans once a month. It’s like a standard bank loan contract in that sense.

Other platforms, like Xcoins, have variable payment frequencies. Make sure to investigate this and ask yourself how and when you prefer to be paid if you lend Bitcoin.

7. P2P vs. non-P2P

Coinloan is a P2P crypto lending platform. This means that lenders and borrowers make contracts directly with each other.

These platforms often have less liquidity (chance of finding the right terms for you).

There are fewer people who want to go through the hassle of finding and setting up a loan versus simply depositing and withdrawing their crypto on one of the platforms.

8. Geo-restrictions

Since all these DeFi

platforms are centered around finance, they all need to comply with KYCDeFi

DeFi stands for Decentralized Finance. DeFi is a new financial system based on the use of decentralized blockchains and smart contracts to create new types of financial products.and AMLKYC

Know Your Customer. Information gathered by cryptocurrency exchanges in compliance with AML (Anti Money Laundering) laws.laws.AML

Anti-Money Laundering. AML laws and restrictions require exchanges to obtain personal information about their customers and their activities.As a result, some platforms may not be available to users in certain regions.

When considering a Bitcoin lending platform, be sure to check which regions it operates in. Even the top crypto lending platform is of no use to you if they don't operate in your country.

9. Limits

Each platform has its own limits on deposits, withdrawals, and terms.

Not only that, but each platform has different limits on each cryptocurrency they offer.

Each platform will have different deposit and withdrawal limits for BTC, ETH, Fiat, and stablecoins.

You might want to check these before deciding which cryptocurrency to use on which site.

Lending Bitcoin vs. Bitcoin HODLing -- which is better?

So, is it worth the hassle to sign up for one of these 5 top crypto lending platforms? Why not just HODL your crypto?

Well, there are a few reasons.

1. Math

The first reason comes down to simple math.

Let’s say you bought 1 BTC at $10,000, and you hold it for 1 year until the price of BTC goes up to $20,000. You sell it and you’ve realized a $10,000 proft.

But what if you did HODL your crypto on one of these top crypto lending platforms?

In 1 year, you would have earned an additional 8% from lending Bitcoin, which would be $800, for a total profit of $10,800 Boom.

Some BTC lending sites even pay interest in BTC. So you’d have made a profit from the BTC price increase too.

2. Security

If you HODL your crypto, then you are fully responsible for it. You need to make sure you have it very safe.

While this is good for experienced investors, this isn’t the case for those who aren’t technology savvy.

If you use a secure crypto lending site which emphasizes its security level, then you’ll rely on their banking-grade technology to keep your crypto safe.

Of course, not every crypto lending site has the best security.

Sites like Xcoins or Coinloan may not have the revenue or the experience to keep your funds as safe as you expect.

My advice: never lend more than you’re afraid to lose.

Keep in mind that DeFi

is a new technology with plenty of hiccups left along the road.DeFi

DeFi stands for Decentralized Finance. DeFi is a new financial system based on the use of decentralized blockchains and smart contracts to create new types of financial products.

3. Peace of mind

This might be the best reason.

If you use a crypto lending site, you won’t have to deal with the stress of trading, securing, or anything else.

Just loan out your crypto and watch your passive income grow.

What is Bitcoin Lending, Exactly?

Bitcoin loan sites are becoming a hot topic.

Cryptocurrency backed loans are fast becoming a new way for the investors, miners

, hedge funds, and even the unbanked to leverage their finances and support their business ideas.Miner

An individual that volunteers computing power to verify transactions on a blockchain in exchange for block rewards.All the while, the HODLers with crypto bags can earn interest on Bitcoin holdings and thus gain more financial freedom through passive income with lending Bitcoin.

All they need to do is learn how to lend Bitcoin for interest.

Overall, the concept is simple:

- For borrowers. You put up a small bag of crypto as collateral. You then get a credit line in fiat

Collateral

An asset, of any kind, that a lender will accept to secure a loan. If the borrower doesn't pay back the loan -- the lender keeps or sells the asset.or stablecoinFiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies.to spend as you see fit. You pay back the loan according to the terms.Stablecoin

Any cryptocurrency pegged to a stable asset for the purpose of reducing price volatility. - For lenders. You put up an amount of crypto and earn interest from lending Bitcoin. Bing, bam, book. It’s quite simple to earn interest on BTC nowadays.

My advice: Lending cryptocurrency is the best way to HODL.- For borrowers. You put up a small bag of crypto as collateral

The Best Bitcoin Lending Sites --- To Stay Away From

Not all cryptocurrency lending platforms are created equal.

It may be nice to earn interest on Bitcoin, but not if your Bitcoins get stolen or misappropriated somehow.

While we all want to earn interest on BTC, we should pay attention to the security of our assets.

When learning how to earn interest on cryptocurrency, it’s necessary to learn to be safe too.

SALT

In my opinion, Salt is not the best crypto lending platform out there.

The company was formed in March 2016 by Shawn Owen as the very first crypto lending site.

Since then, SALT Lending has been known as a platform that allows customers to take out a loan by using crypto as collateral. This means users can obtain a cash loan without exchanging their crypto holdings.

The platform quickly rose in-game through its ICO. However, the ICO promised many things that never happened, such as loans in various U.S. states where Salt had no legal ability to provide them.

Since then, it’s had many speed bumps.

For one, the SEC has investigated Salt for not listing its ICO as a security.

In September 2020, the Securities and Exchange Commission charged the SALT platform with selling an unregistered security. Salt was then required to refund the $47 million it had raised in a 2017 ICO.

Following the recent collapse of FTX, SALT has informed customers that it will halt deposits and withdrawals until further notice.

According to the words of the CEO, Shawn Owen, the FTX crash has impacted the platform’s business. This means that the company will have to pause all transactions on the platform until it determines the impact of the damage.

In line with recent events, the online investing platform Bnk To The Future took action. It informed the public that the non-binding letter of intent to acquire SALT Lending was no longer valid.

This happened as a result of the FTX exposure. Based on their statements, neither SALT nor FTX have influenced Bnk To The Future.

This is because the investing platform has no direct or indirect association with the other platforms. Also, we must remember that all client funds are completely isolated and haven’t been invested.

All this knocks SALT off of our list of the best Bitcoin lending sites.

They don’t even have the best crypto lending interest rates, so why go with them when you can choose another Bitcoin lending platform??

Caution is the Watchword. Beware of Scams.

The old saying rings true: if you don’t own your private keys

, you don’t own your crypto. This holds for crypto lending platforms.Private Key

Private keys are used to spend cryptocurrencies.The concept of lending BTC for interest (and other cryptocurrencies) is outstanding and will flourish. But as we ramp up, there will be growing pains.

A site might have the highest crypto interest rates -- but don’t let greed fool you. Always do your own research!

In January 2018, the cryptocurrency lending platform Davor Coin announced: “Lend us your money and you’ll have the chance to win $1,000,000.”

People around the globe registered and lent their money to Davor Coin. A week later, the company received cease-and-desist letters from the state of Texas.

People wanted to earn interest on Bitcoin, but they didn’t know what was going to happen.

Davor Coin’s lending scheme worked as long as values kept rising. But when cryptocurrency values went crashing -- BTC lending platforms ran with the cash.

Some of them were fined by the SEC and given cease-and-desist letters from the same SEC regulators alleging securities fraud.

Bitconnect

is another great example, as is Lendconnect.Bitconnect

a high-yield ponzi scheme in the cryptocurrency market, guarantee profits to investors. Customer losses are estimated to have exceeded $1 billion and was shut down in January 2018.Both companies offered 'too good to be true’ returns on investment -- and they were too good to be true.

Source: memegenerator.net

These ‘opportunities’ are also called Ponzi schemes

.Ponzi scheme

a fraudulent type of operation where a company attracts investors to send money, with expected profits in return. The company pays back investor profits using later investors’ money. Once the company can no longer attract new investors, then payments cannot be made to clients, the company collapses and investors lose money.Bitconnect offered 1% per day compounded. It's shocking. This cannot go on forever.

This example raises awareness of the worst of crypto lending sites.

Be cautious, do research, and don't expect the moon -- and you'll be safer by far.

There are plenty of legit Bitcoin lending sites offering better interest than a bank, without you needing to go to scam Bitcoin lending sites.

Lending Crypto -- The Future of Passive Income

Money makes the world go round, they say. And crypto is no different.

The in’s and out’s of how to earn interest on lending Bitcoin are getting simpler and easier by the day.

Once these lending platforms find their footing and their audience, we will see fantastic financial tools working to open the world of finance to the unbanked.

Most importantly, it will become incredibly easy to make passive income with Bitcoin lending.

Lending your crypto is becoming safe, easy, and a great way to earn passive income.

I hope you enjoyed my crypto lending comparison. And remember: better to start early, so that compounding interest can work for you.

More Awesome Resources

- The 5 Best Bitcoin Loan Sites to Borrow Crypto

- The 11 Best Cryptocurrencies to Buy

- The Ultimate 17 Best Crypto Tools Checklist

- The 6 Best Bitcoin Cards

FAQ

How does Bitcoin lending work?

If you’re trying to earn from your bags of crypto -- it works by letting a Bitcoin lending site use your crypto to lend BTC out to borrowers. The site will then pay you a part of the money they earn -- this is usually resolved as a fixed interest amount.

Is Bitcoin lending safe?

It is as long as you pick a site with a good reputation and strong security measures. It helps if they have insurance. If you find a site with strong security and insurance, then your funds should be safe in the event of a hack.

Is Bitcoin lending a complicated process?

No. The process is often easier than a standard loan application. The whole process of lending Bitcoin should take between 30 minutes to an hour. Most of that time is waiting for your collateral or lending amount to arrive -- which, depending on the crypto you selected, could be almost instantaneous.

What interest can I earn on Bitcoin lending sites?

If you deposit $1000 of Bitcoin on a term of 4.5% per year -- then you can $45 during the year, or more if the Bitcoin lending site compounds your interest. If you deposit $1000 worth of USDT then you can find terms of 11.5% or more -- which means a yearly income of $115 -- or more if the interest is compounded, and you just need to lend Bitcoin.

- Own a website? Link to this article!

- Willing to spread the love? Share it on social!